Twitter Deal - Free Speech, LBO, and of course, Drama.

Table of contents

Introduction

$\rm\LARGE{T}$he bird is free. But very soon, reality will kick in. With ~26 billion personal equity and ~12.5 billion Debt funding, this game is no longer a cheap-talk for Elon Musk. Mr. Musk’s assuaging post to Advertisers is a telltale sign. Anyone who believes that Twitter will transform into an absolutist free-speech platform will be disappointed, simply because the economics of the deal and the social-media business do not allow that.

Insofar as the ‘Free Speech’ objective is concerned, the first task at hand for Elon Musk is to institute a more balanced content moderation policy that aligns with the law of the land. However, achieving unbiased content moderation can present challenges as it may conflict with the objective of maximizing advertisement revenue. This friction is evident on platforms like Twitter, where some corporations are leaving, and advertisers are becoming skeptical.

An open and diverse avatar of Twitter will encourage a wider range of commentaries, even those that lean towards the extremes. Emotionally intense left-leaning commentary typically doesn’t damage a brand’s image. However, people often perceive expressions of extreme right-leaning views as distasteful, even though the First Amendment protects those views. Advertisers and society predominantly gravitate towards emotionally resonating narratives. They are likely to distance themselves from a platform that doesn’t actively moderate extreme right-leaning comments. Therefore, for Twitter to have a substantial impact on free speech, the platform must develop alternative revenue sources and decrease its reliance on advertising revenue. Musk’s creation of Twitter Blue, a subscription-based model, signifies a crucial move in this direction. While I won’t delve into the conceptual inconsistencies with the current form of Twitter Blue services, the concerted effort toward revenue diversification is a positive step.

Twitter’s position before the acquisition

Financial

In the years leading up to the acquisition, Twitter experienced steady revenue growth. By 2021, the company’s annual revenues reached $5.08 billion, marking a 36% increase from the prior year, largely due to an expanding active user base. However, Twitter’s financial standing was not without its problems. The company consistently reported negative net income, revealing significant net losses of $221 million and $1.16 billion for 2021 and 2020, respectively. This pattern of financial losses, evident in eight out of the ten fiscal years prior to the acquisition, highlighted the serious fiscal challenges facing Twitter.

Social

Beyond financial struggles, Twitter faced several social and ethical controversies, spanning issues of content moderation, data security, and transparency.

- Content moderation: The company faced accusations of conservative voices censorship, suppression of stories about Hunter Biden, and failing to stop the dissemination of harmful content. Moreover, Twitter’s opaque decision-making process regarding content moderation drew heavy criticism.

- Data security: A 2020 hack exposed the personal information of millions of users, casting a spotlight on Twitter’s data security.

- Transparency: Twitter has been accused of being opaque about its decision-making process and functioning of its recommendation algorithms.

These issues had severe repercussions for Twitter’s user base, its reputation, and its capacity to serve as a platform for public discourse.

Adding to these concerns, Peter Zatko, Twitter’s former security chief, leveled serious allegations against the company, including extreme deficiencies in security practices. Zatko claimed that Twitter demonstrated weak controls over employee access to user data, was subject to foreign government interference, and lacked transparency about its bot problem.

Amidst these financial and ethical challenges, Twitter’s prominent role in public discourse appeared to captivate Elon Musk. Given these complications, however, one may ponder Musk’s motivation behind acquiring Twitter, particularly at a high price and without the usual rights to due diligence. Does he discern untapped potential for the platform’s future growth, or is he driven by a fervently held social cause? Is it truly an excellent investment opportunity, especially when the risk-free interest rate is around 3.5%? Alternatively, could this investment primarily serve to promote a social cause that Musk strongly believes in? Or perhaps it represents a combination of both factors?

Musk’s motivation

Understanding Elon Musk’s interest in acquiring Twitter involves navigating a labyrinth of complex motivations. Potential explanations could be:

- His ambition to transform Twitter into a platform for unrestricted free speech. Musk, a vocal critic of Twitter’s moderation policies, envisions Twitter as a platform where all legal speech should be permitted. However, his attempt to abandon the acquisition in September, 2022, though eventually thwarted, indicates his reluctance to stake his reputation for Twitter’s transformation.

- The desire to augment his influence on the platform. As a prolific Twitter user, Musk has utilized the platform to disseminate his businesses and ideas. He may believe that ownership would provide greater control over content dissemination and platform usage.

- A strategic business move aimed at generating a return on investment. Musk, an astute businessman, may perceive an untapped financial potential in Twitter. By acquiring, restructuring, and eventually divesting the company, he could realize a significant return.

Clearly, Musk’s acquisition of Twitter may not be purely altruistic. His attempt to retreat from the deal suggests he reconsidered the hefty price might be more than he is willing to lose to achieve his social objectives.

From a financial perspective, while Twitter’s financial performance may not have been stellar, there could be underlying potential that Musk sees in terms of future growth, revenue diversification, or strategic synergies with his other ventures. As an entrepreneur known for his unconventional and long-term thinking, Musk may have a unique perspective on Twitter’s potential value beyond immediate profitability.

Additionally, Musk has shown a propensity for championing social causes that align with his vision for a better future. Investing in Twitter could be viewed as a means to influence the platform’s direction, improve its governance, or promote responsible use of social media for positive societal impact. This socially driven motive may complement his entrepreneurial interests, resulting in a convex combination of both financial and social objectives.

Hypotheses

This study is guided by two primary hypotheses, which are intended to provide insights on the motivations behind Elon Musk’s decision to acquire Twitter:

- The Profitable Investment Hypothesis: Acquisition of Twitter will yield an Internal Rate of Return (IRR) of approximately 20-25% if Elon Musk divests after a period of 5-7 years.

- Free-Speech Hypothesis: The acquisition was driven by Musk’s intent to promote an unbiased platform and will allow for the uncensored expression of a broad spectrum of viewpoints. This hypothesis will be examined by considering two key measures:

- The Diversity of Viewpoints: This will involve tracking the variety of perspectives represented on Twitter, particularly those that challenge mainstream narratives. A more diverse range of opinions could indicate less censorship and therefore a greater commitment to free speech.

- Reduction in Content Moderation: This will involve tracking changes in Twitter’s content moderation policies and their enforcement. If Twitter’s moderation becomes less restrictive post-acquisition, it could indicate a move towards less censorship and a stronger commitment to free speech. These specific, measurable elements related to free speech are chosen over the broader term ‘free speech’ due to the latter’s ambiguity and the challenges it presents in measurement. Diversity of viewpoints and content moderation are key facets of free speech, but they are more specific and relatively easier to measure.

Methodology

Profitable Investment Hypothesis:

To validate the ‘Profitable Investment Hypothesis,’ a Leveraged Buyout (LBO) Model has been constructed. LBO model proves particularly appropriate given the significant debt utilized in financing the acquisition - a process where existing equity is repaid through a combination of acquisition debt and new equity. Servicing of this debt is anticipated to occur throughout the holding period, leading up to its full repayment prior to distributing sales proceeds among private investors upon exit. Moreover, the model considers different operating and exit scenarios— Downside, Base, and Upside, generated based on variables such as projected growth rates, potential effects on revenue streams, and operating expenses. The aspiration of private equity investments, such as this, typically revolves around achieving an Internal Rate of Return (IRR) of 20-25% whilst safeguarding against the loss of the invested capital. This model envisions an Initial Public Offering (IPO) exit after a holding period of five years. This time frame is deemed suitable as it allows for a sufficient period to accommodate the inherent complexities related to Musk’s financial and non-financial objectives. Considering the substantial deal size and potential antitrust restrictions, an IPO exit strategy—rather than strategic acquisition by a larger entity—emerges as the most fitting alternative. As such, the IPO exit strategy presents a plausible path to attain the desired IRR of 20-25% over a span of 5-7 years, as posited by the ‘Profitable Investment Hypothesis.’

The table below presents a comparison of these scenarios:

Operating Scenarios

Particulars Downside Base Upside Advertisement Revenue - mDAU growth rate 3-7% 8-15% 12-20% - ARPU growth rate (2)-5% 0-6% 2-10% Subscription Revenue - Twitter Blue - Monthly subscription fee growth rate 0% 2% 4% - Existing subscribers renewal rate 90-92% 92-94% 94-96% - New subscribers renewal rate 85-87% 87-89% 89-91% - New subscriber % Base 16-96% 18-98% 20-100% Operating Expenses growth rate 3-5% 3% 2-3% 2029 Exit EBITDA Multiple 4x 12x 28x

Note: The growth percentages mentioned above are applicable for the explicit forecast period of FY23-FY31.mDAU is monetizable daily active users, ARPU is average revenue per user

These scenarios outline the expected growth rates and factors influencing the revenue streams and operating expenses within each scenario.

Exit Scenarios

I am assuming an IPO exit after five years.

-

Holding period of 5 Years: 3 Years exit period is unlikely because neither financial nor (alleged) non-financial goals will likely be achieved in that timeframe.

-

IPO: exit is considered the most plausible option due to the expected substantial deal size and potential antitrust limitations for large potential acquirers such as Facebook or Snap.

By considering a five-year holding period with an IPO exit strategy, it allows for a longer period to work towards achieving the desired goals and targets before going public. This approach takes into account the complexity and scale of the objectives involved, making an IPO the most feasible and strategic choice for a potential exit.

Free-Speech Hypothesis

To evaluate the ‘Free-Speech Hypothesis,’ the methodology aims to explore changes in the representation of a broad array of viewpoints and the moderation policies post-acquisition.

A mixed-methods approach is employed in this investigation. Quantitative analysis includes examination of operational metrics such as the number of active users and the diversity within user demographics. These data can indicate whether a wider variety of viewpoints are present on the platform post-acquisition, suggesting a decrease in censorship.

On the qualitative front, third party user surveys will be studies to gauge perceptions of safety and freedom of expression. Case studies on the handling of controversial speech under the new policies could be included.

This mixed-methods approach facilitates a comprehensive understanding of the free-speech landscape post-acquisition, amalgamating quantifiable metrics with user perceptions. For ensuring reliability and validity, quantitative metrics are intended to be tracked consistently over a defined period and surveys based on diverse, representative sample of users will be used. This strategy allows for thorough evaluation of both the tangible and intangible aspects of the ‘Free- Speech Hypothesis.’

Results

Examining the Profitable Investment Hypothesis

Sources and Funds Schedule

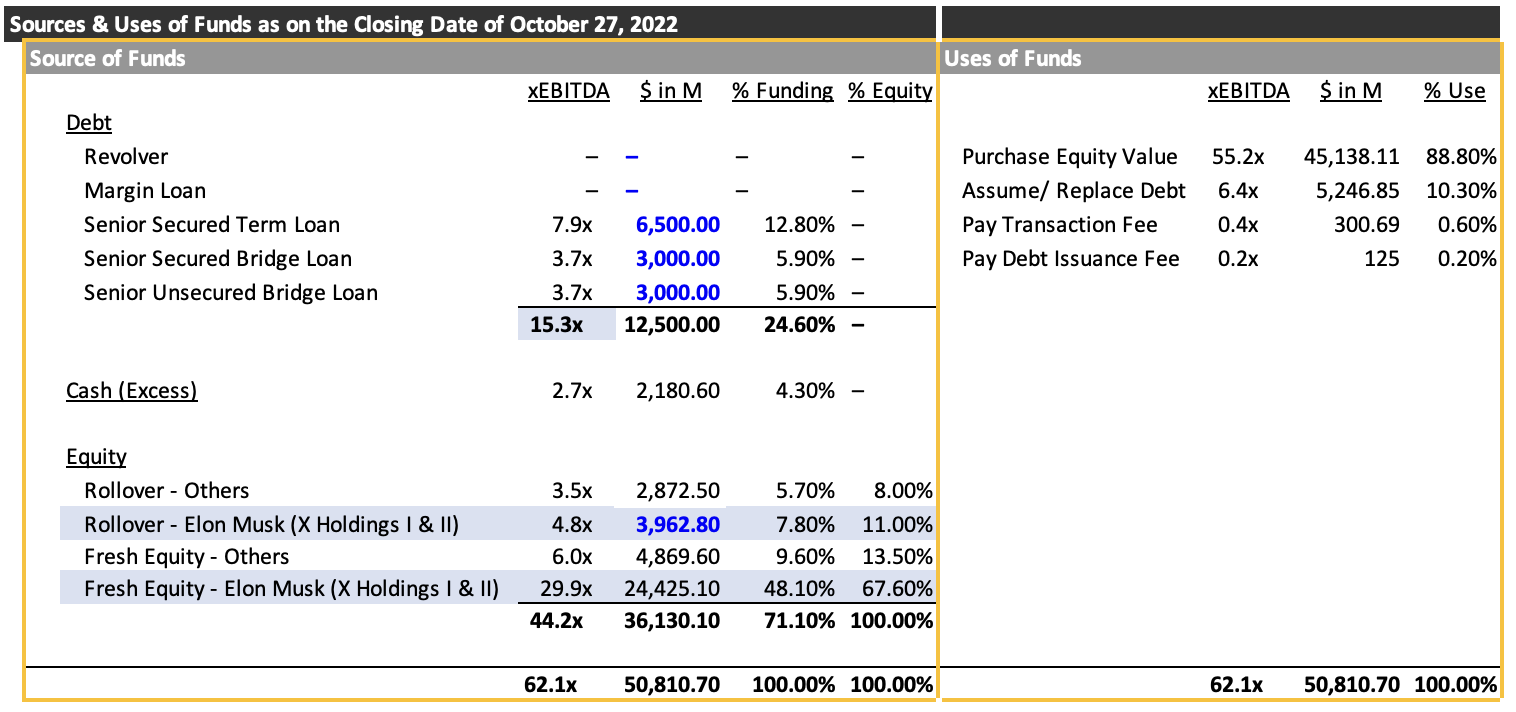

Sources and uses of funds table is a common way to present how an acquisition will be financed and where the funds will go. In this case, Twitter is being acquired and the date of acquisition or closing is set for October 27, 2022.

The deal, requiring a total $50,810.7 million, will be financed through a combination of debt (24.6%), excess cash (4.3%), and significant equity contribution (71.1%). Within the equity component, fresh equity, notably from Elon Musk through X Holdings I & II, forms the lion’s share at 57.7%.

On the allocation side, a substantial 88.8% of the funds will go towards purchasing Twitter’s equity. A smaller yet significant portion (10.3%) will be directed to assume or replace Twitter’s existing debt. Transaction and debt issuance fees represent minor components of the usage of funds, totaling 0.8%.

Overall, this transaction showcases a heavy reliance on equity financing, particularly from Elon Musk, while the use of funds is largely dominated by the purchase of Twitter’s equity. The xEBITDA figures show how the dollar values translate into a multiple of the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA), a common measure of a company’s operating performance, and a proxy for cash flows.

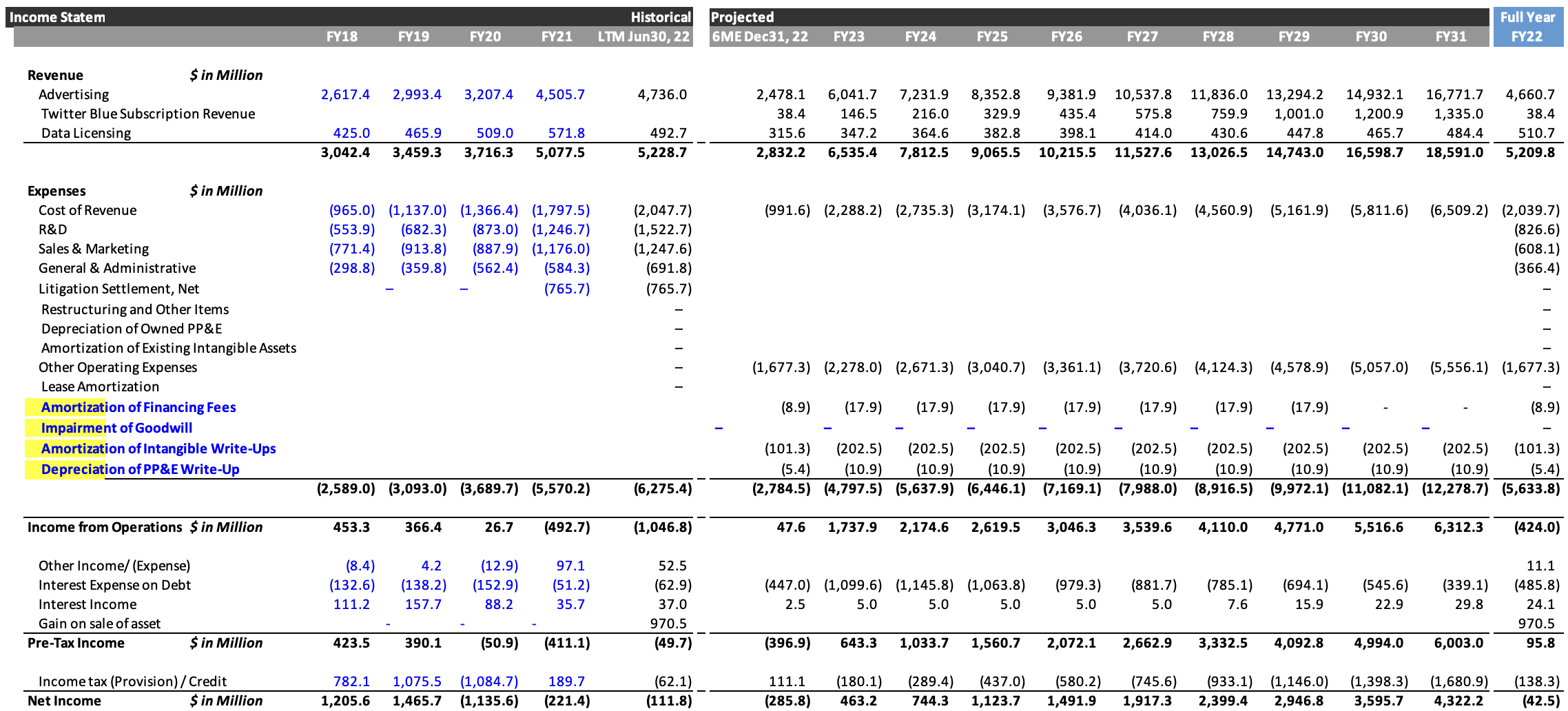

Revenue and Cost projections - Base case

Key insights derived from the projected income statement for Twitter for the base case:

- Revenue growth: Twitter’s revenue is anticipated to more than triple from $5.2 billion in FY22 to around $18.6 billion by FY31. The main driver of this growth is advertising, expected to increase from $4.7 billion in FY22 to nearly $16.8 billion in FY31. Twitter Blue Subscription and Data Licensing revenues are also expected to contribute to this growth, albeit to a lesser extent.

- Interest expense: Interest expense on debt is expected to rise significantly from $485.8 million in FY22 to peak at $1.1 billion in FY24, before gradually declining to $339.1 million by FY31. This suggests a reduction in debt over time. Interest expenses peak in FY24, indicating an expected reduction in debt levels in subsequent years.

- Operating profitability: From operating at a loss of $424 million in FY22, Twitter is projected to achieve robust operating income of $6.3 billion by FY31, reflecting improved cost management and robust revenue growth.

- Net income recovery: Despite starting from a net loss position in FY22, Twitter is expected to witness sustained profitability from FY23 onwards, reaching a net income of $4.3 billion by FY31.

Twitter’s income statement projection displays a promising future with significant revenue growth, improved profitability, and reduced debt levels, in the base case. However, the downside case projects a different picture.

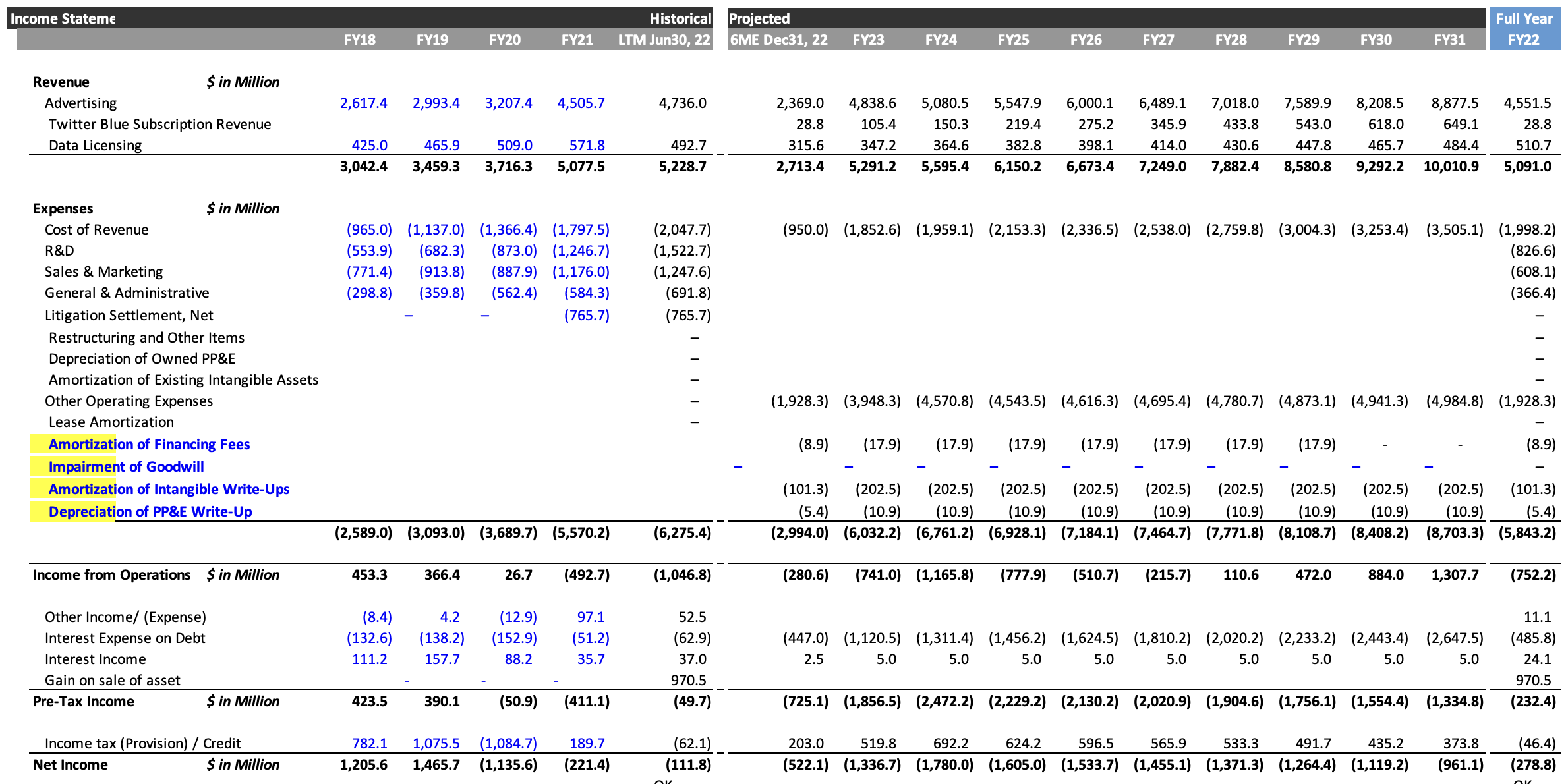

Revenue and Cost projections - Downside case

Downside projected income statement for Twitter is marked by slowing revenue growth, increasing expenses, and rising interest expenses:

- Slowing revenue growth: The growth in Twitter’s revenue is projected to slow down, increasing from $ 5.1 billion in FY22 to approximately $10.0 billion by FY31. The Advertising segment remains the dominant revenue driver but at a slower pace.

- Increasing expenses: Twitter’s expenses are projected to rise at a faster pace than revenues, implying a risk to profitability. Operating expenses are expected to nearly grow 1.5x from FY22 to FY31, leading to consistent operating losses throughout the forecast period.

- Net loss position: Starting from a net loss position in FY22, the downside case suggests that Twitter’s net losses are likely to continue till FY31. This is a stark contrast to the base case forecast where Twitter was expected to witness sustained profitability from FY23 onwards.

- Rising interest expenses: Twitter’s interest expense is projected to rise consistently from FY22 to FY31, suggesting an increase in debt levels and potential solvency risk in the long term.

In summary, the downside projection for Twitter’s income statement suggests a challenging outlook, with slowing revenue growth, rising costs, sustained net losses, and increasing interest expenses. These factors could lead to heightened financial risk if not addressed.

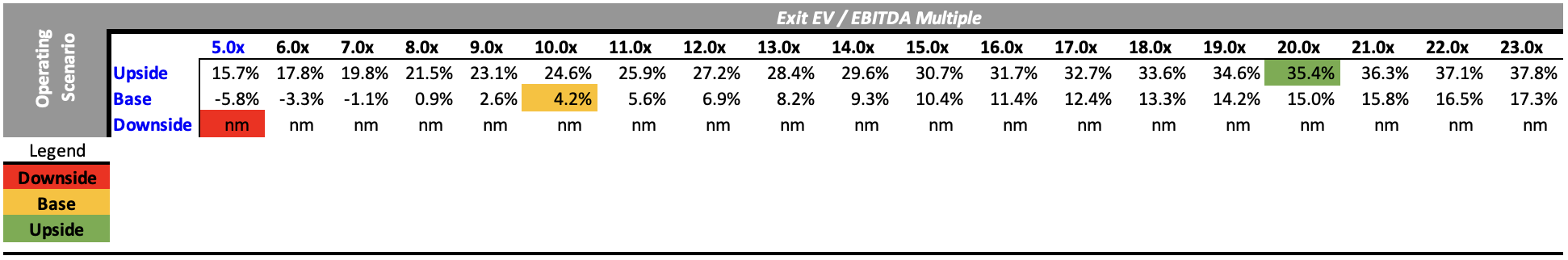

Returns

Note: nm is negative

Note: nm is negative

In the ‘Upside’ scenario, the investor would achieve the desired IRR of at least 20% if Twitter is sold at an Exit EV/EBITDA multiple of roughly 8.0x. This means that the investor would need Twitter’s performance to significantly exceed current expectations and the company to be sold at a high exit multiple.

In the ‘Base’ scenario, the investor will not reach the desired IRR of 20%, even at the maximum considered exit multiple of 23.0x. The IRR in this scenario only reaches 17.3% at this exit multiple. Therefore, under normal operating conditions, even with a very high exit multiple, the investment will not meet the investor’s desired return.

The ‘Downside’ scenario is not applicable in this context, as it shows a negative IRR across all exit multiples, indicating a loss on the investment.

In summary, to achieve a 20% IRR, the investor would need Twitter’s performance to exceed current expectations significantly. If Twitter’s performance aligns with the ‘Base’ scenario or worse, the investment will not meet the 20% IRR target. Therefore, the investor would need to have a high level of confidence in Twitter’s ability to outperform current expectations to justify the investment.

Furthermore, the downside scenario consistently indicates a negative IRR, it implies that the Multiple on Invested Capital (MOIC) would be less than 1x. This would be a red flag for most investors, and under these circumstances, they would likely be very hesitant to proceed with the investment unless there are very compelling reasons to believe that the actual performance will be much better than the downside scenario.

The reasons behind low IRR are as follows:

-

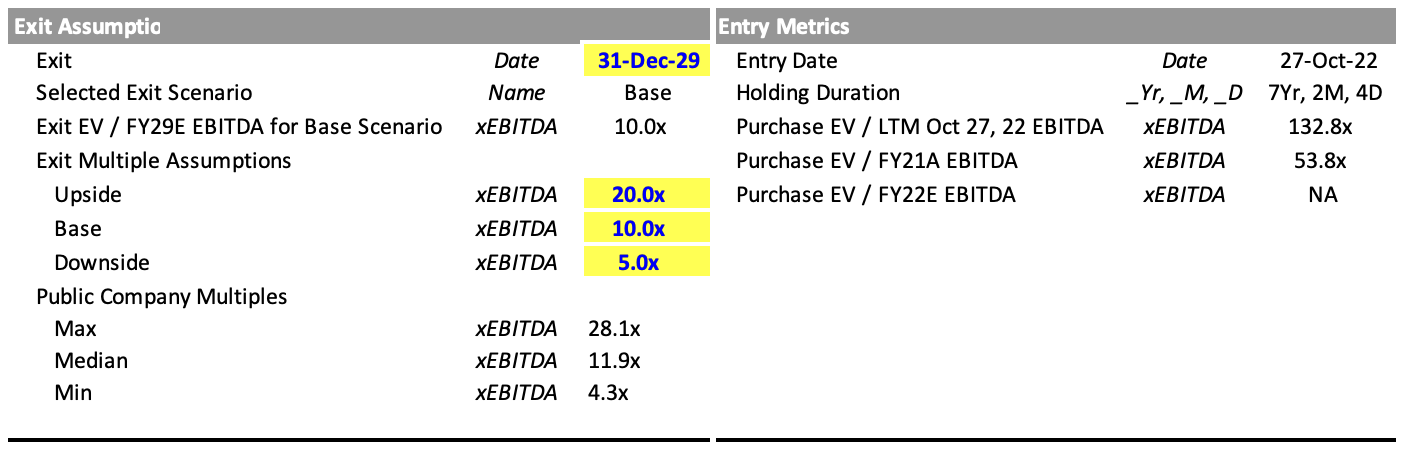

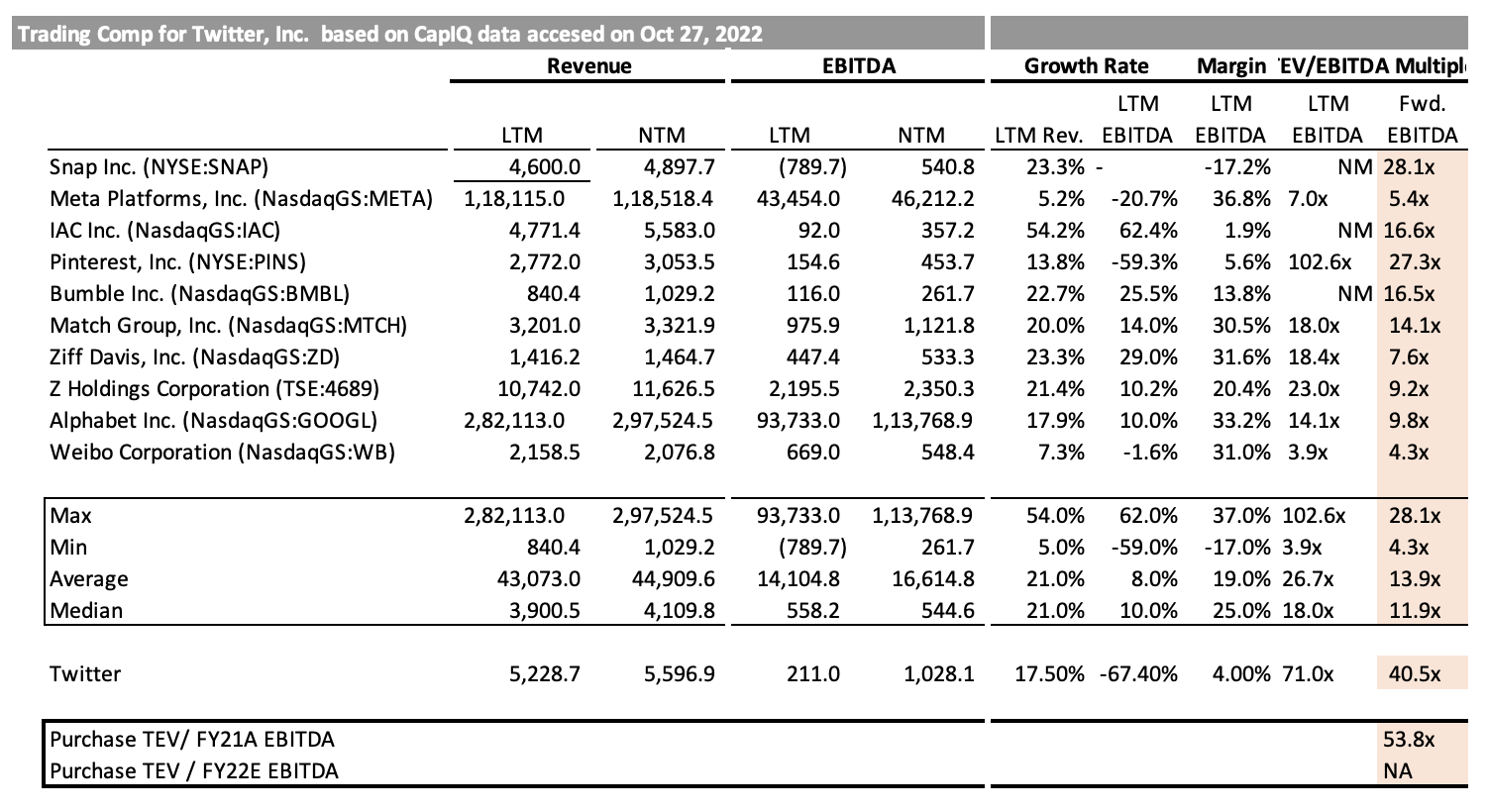

High Entry Multiple: 54x EV/ FY21 EBITDA, where the forward multiple of comparable trading companies was 4.3x-28.1x.

- High Debt Cost: $12.5 Billion loan provided by a consortium of Banks pegs at ~15x EBITDA. With such high leverage, interest/ debt repayment is eating up most operating cash flows. In the Base case, the investment generates net positive cash (after debt payments) only in FY27. See Sources & Uses Schedule and Cash Flow Statement in the full model.

- Prospective growth and profitability challenges: In the Base case, the effective revenue growth rate and EBITDA Margin are already close to the upper bound of what most analysts have predicted for social media companies. ARPU has witnessed a decline in the historical period. While mDAU numbers have been growing in the past, if Elon Musk’s allegations are true, then a significant chunk of that mDAU is fake.

- IPO exit uncertainties: M&A exit is highly unlikely because a) likely interested businesses would face antitrust issues and b) the size of the deal. IPO exit brings much uncertainty on the valuation and exit timeline fronts, and both have a non-trivial adverse impact on return.

Full LBO Model Download

Examining the Free-Speech Hypothesis

Evaluation of the Free-Speech Hypothesis entailed a multifaceted exploration of changes in Twitter’s user representation and moderation policies following Musk’s acquisition. The application of a mixed-methods approach has generated diverse findings.

An appreciable rise in the active user count on Twitter post-acquisition has been observed/claimed. This might indicate the platform becoming more inclusive due to a possible decrease in censorship, as evidenced by the following:

- Reinstatement of accounts previously suspended for alleged violations of Twitter’s terms of service, thus implying an increased acceptance of divergent viewpoints. Notable public figures whose accounts have been reinstated include Donald Trump, Jordan Peterson, Kanye West, and Babylon Bee.

- Modifications to Twitter’s moderation policies that have created higher barriers to content removal, potentially enabling a broader spectrum of content.

However, a corresponding increase in hate speech has also been noted. This undesirable trend, traced through content analytics and user reporting, could indicate a downside to the ‘openness’ of the platform and raises questions about the inclusivity and safety of the Twitter environment. There have been anecdotes of some appreciating the wider range of viewpoints, and others expressing concerns over their safety and the quality of discourse.

Thus, it’s not definitive that Twitter has become more open or inclusive post-acquisition. Despite an uptick in active users suggesting growing diversity, the accompanying rise in hate speech and harassment may undermine these gains. It is premature to conclusively categorize Twitter’s new trajectory because the effects of policy changes on the discourse quality and user experience are still unfolding.

Consequently, further longitudinal analysis is needed to provide more definitive conclusions on the Free-Speech Hypothesis. The ultimate impact of Musk’s ownership on Twitter’s free speech dynamics is yet to be fully realized and will continue to emerge over time.

Conclusion

This research examined two core hypotheses surrounding Elon Musk’s motivations for acquiring Twitter. Using a detailed LBO Model and through careful analysis of available data and information, the Profitable Investment Hypothesis has not found substantial support, and more longitudinal study is required to conclude on the Free-Speech Hypothesis.

The Profitable Investment Hypothesis, postulating that the acquisition was primarily a financial decision, is not strongly supported by the available evidence. Analysis of Twitter’s financial situation indicates considerable hurdles in achieving substantial profitability. The high entry multiple and extensive debt cost may render this acquisition financially precarious. Furthermore, the attainment of a 20% IRR is contingent upon Twitter substantially exceeding Base-case forecasts. Consequently, the anticipated financial benefits detailed in the Profitable Investment Hypothesis do not appear to be materializing, coupled with a non-trivial chance of negative returns.

Regarding the Free-Speech Hypothesis, the results are equivocal. Some evidence suggests an increase in platform inclusivity and diversity of viewpoints. However, these potential advantages appear to be somewhat counterbalanced by an upswing in hate speech incidents, leading to concerns about platform safety and inclusivity.

The growth in user count may be perceived as an indicator of the platform’s increased openness. Yet, the corresponding rise in hate speech incidents renders it uncertain whether this openness enhances the discourse or fosters a more hostile environment. Analysis indicates that the long- term impact of Musk’s ownership on free speech dynamics on Twitter is yet to fully unfold, necessitating a comprehensive longitudinal analysis. Musk’s public statements indeed favor free speech, yet these alone do not conclusively support the hypothesis. As scientific rigor mandates reliance on empirical data over personal declarations, the acceptance of this hypothesis is tenuous without more concrete evidence.

In conclusion, the motivations behind Musk’s acquisition of Twitter remain somewhat enigmatic. Neither the Profitable Investment Hypothesis nor the Free-Speech Hypothesis can be fully substantiated based on the current data.

Despite the uncertainties and mixed findings, the enduring strength of Twitter’s brand, expansive user base, and substantial influence over news dissemination cannot be overlooked. History has shown that Musk is not averse to tackling ventures of high complexity and risk, which could potentially herald a substantial transformation of the platform. However, it is apparent that considerable restructuring and effort will be required to optimize this venture, and Elon Musk’s philosophy of “When something is important enough, you do it even if the odds are not in your favor” suggests a commitment to taking on meaningful endeavors despite the challenges.

Appendix

A1. Deal Financing - Sign Vs. Close

Instruments Original Commitments (April 25 Sign) Intermediate Changes Final Deal Financing (best guess for Closing) Margin Loan Up to \$12.5 Billion backed by Tesla Shares \$(12.5) Billion; Initial Commitment expired by May 24, 2022 Zero Debt Up to \$13 Billion (Senior Secured Term Loan \$6.5 Billion + Senior Secured Revolvig Facility \$0.5 Billion + \\Senior Secured Bridge Loan \$3 Billion + \\Senior Un-secured Bridge Loan \$3 Billion. Banks planned to sell of all the loans in secondary market except the revolver No Change \$12.5 Billion Acquisition Loan + \$0.5 Billion Revolver Elon Musk - New Equity Upto $21 Billion Additional $12.5 Billion commitment obtained by May24 ~\$22.243 Billion (out of the total commitment of \$33.5 Billion Elon Musk - Equity Rollover ~3.963 Billion (73.115 Million Shares * Offer Price of 54.20) No Change ~3.963 Billion (~73 Million Shares * 54.20) Other Sponsors - New Equity Zero \$7.14 Billion commitment obtained by May 4 $7.140 Billion Other Sponsors - Equity Rollover Zero ~\$2.269 Billion (Offer Price*Entire Shareholding of QIA and Saudi Prince AB Talal) ~\$2.269 Billion {54.20*(0.060 + 34.949)} Total ~\$50.463 Billion ~\$9.409 Billion ~\$48.615 Billion (Out of the total available commitment of \$59.872 Billion)

A2. Roller Coaster Timeline

- March - April’ 2022: Elon Musk, the Corporate Raider powered by Free Speech Absolutism.

- Mar 14, Musk acquired more than 5% equity shares of Twitter

- Apr 1-4, Investment was publicaly announced on Apr 1, sec fling was done on April 4. Also Musk agreed to a) become Class II director up untill the expiry of FY 2024 Annual Meeting, and b) not be acquire >14.9% beneficiary ownership.

- Apr 9, Musk decided not to join the board.

- Apr 13, Musk made proposal to buy all outstanding stock at ///$54.20 per share, a 38% premium over undisturbed price prior to announcement of Musk’s equity stake. Note: the proosal was conditional on Financinf and Business Diligence requirement.

- Apr 15, Board instituted the Rights Plan (Poision Pill).

- Apr 20, Musk waived the Financing (having already obtained the reuqired financing committments) and Business Diligence requirment from the proposal, and thretened of commencing a tender offer if the propsal fails.

- Apr 25, Merger Agreement executed.

May’ 2022: Tumultuous Market taking away the charm of Free Speech Idealism- May 5: Fed increased the benchmark federal funds rate by 50 basis points, in response to rising inflation (CPI Inflation >8% in May’22). TMT stocks getting battered in the stock market. Stronger dollar further dinging multinational stocks.

- May 4-May 24: Margin loan committment expired; replaced by more equity commitment from Mr. Musk. Also obtained fresh equity commitments, and rollover commitments from other investors. (LTV ratio for Margin loans is ~20%, and with declining Tesla stock prices more Tesla shares had to be collateralized to support the margin loan)

June’ 2022: Musk, the reneging yet realist businessman- Jun 6: Reiterated demand of information Domesday Book is instituted to survey the English lands of William the Conqueror.

- Jul 8: First Termiantion letter; basis of termination: Not meeting reasonable data request for purposes related to the consummation of the transaction, as allegedly, Twitter failed to provide data required to enable Musk to amake an independent assesment of the spam accounts on the platform.

- Aug 29: Second Termination letter; basis of termination: Non-disclosure of materail facts known to Twitter as on the Merger Date wrt. the Wistlebolower report filed by erstwhile Chief Security Officer Peiter Zatko about seriosu misconduct at Twitter (Non-compliance with FTC norms + Vulnerability to systemic disruptions due to data center failures/ malicious actors + IP infringement + acquiescance to certain deamands of the Indian Governemnt) [Food for thought: The developed API initally shared with MR. Musk had rate limit lower than what Twitter provides to its emeterprise customers commercially + Had artifical cao on queries. Why?]

- Sep 9 Third Termination Letter; Basis of Termiantion: $7.75 Million Severence Payment to Peiter Zatko, allegedly in non-compliance with the Merger Agreement, thereby weaning Musk Parties from the obligation to Close.

October’22: The compelled Musk - Reversal and Deal Closure- With Twitter suit for specific performance and an emminent trial under a tough Court, Musk realised, he is too late (As a side note, it is so satisfying to see how under a functioning Rule of Law, even the world’s richest man is forced to fall in line and comply)

- Musk knew he had a weak case. He had waived off diligence requirement and after having obtained firm — and unconditionla on diligence — funding , it was quite preposterous to cliam that information on spam accounts was ‘essential for the consumation of the deal’. And you dont go to trial with a weak case. Also, Twitter never wanted to get acquired - they had a poison pill in place. So, ELon Musk, who first forced himself into buying the Company, and then reneging would have caused severe blow to the shareholder value , would have faced the battery of lawsuits. Buying Twitter was Mr. Musks response to the situation he brought himself into. Also, worth noting that it was in Mr. MUsk’s interest to buy term per the original arrangement, becuase any renotiation in the offer price, would have given opportunities to banks to reprice the loan, which would have been more expensive.

- Oct 3, Musk agreed to proceed per the original Merger terms

- Oct 27, Deal Closed